2025 Ranking of China's Energy Storage Export Orders (by Global Region)

导读

In 2025, Chinese energy storage companies secured over 163 GWh in overseas orders, marking 246% YoY growth. This analysis explores their rise as global rule-shaper—led by technological innovation in LFP and solid-state batteries, expansion into欧美 and emerging markets, and challenges like geopolitical risks and evolving standards. Featuring regional order rankings and strategic insights for sustainable global competitiveness.

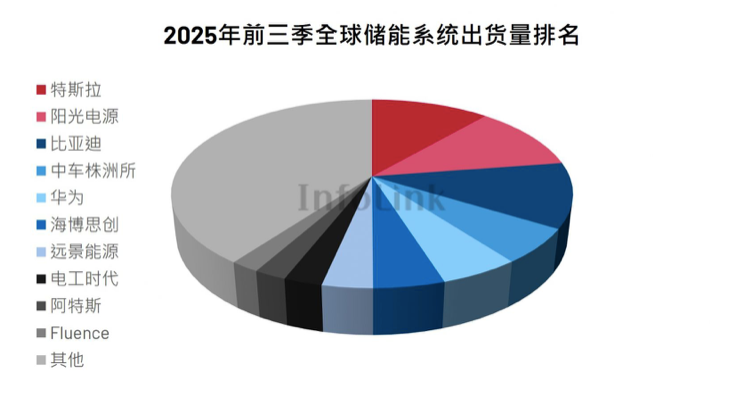

According to an article published by CCTV Finance Observer, in the first half of 2025, Chinese energy storage companies secured new overseas orders reaching 163 GWh, marking a year-on-year increase of 246%. Against the backdrop of the accelerating global energy transition, Chinese energy storage enterprises are experiencing a concentrated boom in overseas markets and rising at an unprecedented pace. Additionally, based on incomplete statistics from the TTIR, since the beginning of 2025, the total scale of overseas orders signed by the top 10 energy storage giants has amounted to 166.26 GWh, which is already 2.04 times the new installed capacity (81.5 GWh) in the global new energy storage market in 2024. The continuous emergence of these gigawatt-hour-level orders signifies that Chinese energy storage companies have transformed from mere product exporters into key shapers of the rules in the global energy storage market. According to the latest statistical data, the rankings and figures for the global energy storage cell shipment rankings for the first three quarters of 2025, the list of the top 10 most globally competitive listed Chinese energy storage enterprises, and the overseas order rankings of China's top 10 energy storage giants are as shown in the following charts:

2025 Top 10 Most Globally Competitive Listed Chinese Energy Storage Companies (Data Source: TTIR)

2025 Ranking of Overseas Orders from China's Top 10 Energy Storage Giants (Data Source: TTIR)

However, it is important to note that many overseas orders are only letters of intent, and the execution cycles for numerous orders span 2-3 years or even longer.

The rankings of overseas orders for energy storage companies in specific regions are shown in the image at the end of the article. By conducting an in-depth analysis of these Chinese energy storage enterprises' overseas order deployments and considering broader industry trends, we can observe the following characteristics: the acceptance of Chinese energy storage products in European and American markets has improved, reflecting advancements in the technical performance and quality standards of Chinese products. Chinese companies are accelerating their expansion into emerging markets, where demand for energy storage solutions is driven by weak grid infrastructure. Furthermore, some large-scale overseas projects are being secured by a limited number of enterprises, with leading energy storage firms demonstrating significant advantages in winning major orders. Underlying these shifts in the market landscape is the comprehensive industrial chain advantage possessed by Chinese energy storage companies. China has established a complete global ecosystem for the energy storage industry, endowing its enterprises with strong competitive edges in cost control, delivery cycles, and product/service customization. It is also evident that the core driver of this wave of global expansion is technological innovation. In the lithium battery sector, Chinese companies are globally leading in lithium iron phosphate battery technology and are at the forefront worldwide in the R&D of sodium-ion and solid-state batteries. Despite the surge in overseas orders for Chinese energy storage companies, we believe enterprises will still face certain complex challenges. These challenges include policy and geopolitical risks, such as the U.S. Inflation Reduction Act's requirements for localized production of battery raw materials; frequent adjustments to technical standards, like the carbon footprint requirements under the EU's new battery regulation; and difficulties associated with long delivery cycles and coordination for large multinational projects, among others. In the future, Chinese energy storage companies venturing overseas should shift from pursuing scale expansion to building sustainable competitiveness. This can involve diversifying market presence to avoid over-reliance on any single country and establishing local production, R&D, and service networks in key markets. Simultaneously, China needs to actively lead and deeply participate in the formulation of international standards, translating its technological advantages into industry norms to reduce market access barriers.